Read our region-by-region economic outlook and latest forecasts for investment returns.

.

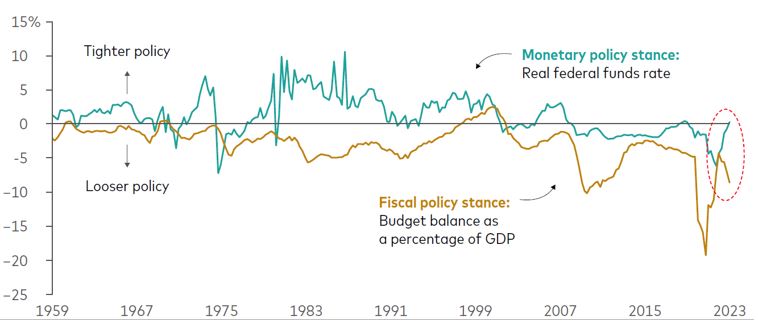

Over decades, U.S. fiscal and monetary policies have mostly travelled in the same direction, toward either more restrictive (tighter) or less restrictive (looser) financial conditions. Recently, though, they have diverged. Legislation intended to boost the economy after the COVID-19 pandemic has run into an aggressive series of central bank interest rate hikes meant to quell the post-pandemic recovery’s rampant inflation.

U.S. fiscal and monetary policies heading in different directions

Note: The federal funds rate is the annualised rate of interest that banks charge one another for overnight loans. The Federal Reserve sets a target rate that controls the effective rate. The real (inflation-adjusted) federal funds rate is the effective federal funds rate minus the 12-month rate of core inflation (which excludes volatile food and energy prices), as measured by the Consumer Price Index. The budget balance (surplus or deficit) is for the federal government and is a rolling 12-month sum.

Sources: Vanguard calculations through June 30, 2023, using data from the U.S. Treasury, the Bureau of Labor Statistics, the Federal Reserve Bank of New York, and the Bureau of Economic Analysis.

In short, explains Josh Hirt, a Vanguard senior economist, “Monetary policy is still working its way through the economy, trying to constrain activity even as the impacts of supportive fiscal policy have kicked in. This is one of the reasons we believe the economy faces a period of higher sustained interest rates than we’ve grown accustomed to seeing.” Vanguard believes that the Federal Reserve may need to raise rates further and keep them at their highest levels for an extended period in the face of continued economic resilience.

Recent Vanguard research concludes that the “neutral rate of interest”—a theoretical rate that neither promotes nor restricts economic activity—is higher than many may have thought. That finding and our related policy analysis support our view that the Fed may need to raise its federal funds target rate by a further 25–75 basis points before ending a rate-hiking cycle that began in March 2022 and has totaled 525 basis points. (A basis point is one-hundredth of a percentage point.) The Fed’s rate target currently stands at 5.25%–5.5%. We don’t foresee the central bank cutting its target until the second half of 2024.

The views below are those of the global economics and markets team of Vanguard Investment Strategy Group as of September 13, 2023.

Region-by-region outlook

Australia

The Reserve Bank of Australia (RBA) has left its cash rate unchanged, at 4.1%, for three consecutive policy meetings, but something noteworthy has been missing from its statements: an indication that the bank has completed its rate-hiking cycle.

- Vanguard believes that one or two more quarter-point rate hikes, to a peak rate of 4.35%–4.6%, may be in order. “The RBA not signaling the conclusion of rate hikes suggests at least one more is a real possibility,” said Alexis Gray, a Vanguard senior economist. “Inflation has been coming down, but several factors support continued household consumption, including rising wages and housing and share prices that have held up well this year.”

- We expect headline inflation to fall to around 4.5% on a year-over-year basis by the end of 2023—it was 4.9% in July—as higher interest rates work to dampen demand, and to the RBA’s target band of 2%–3% in late 2024 or 2025.

- Leading indicators suggest the pace of economic growth has slipped slightly below trend in the face of higher interest rates. We continue to expect GDP growth of 1%–1.5% for all of 2023, with risks skewed to the downside, and to assign about a 40% probability of recession over the next 12 months.

- We expect the unemployment rate to rise gradually to about 4% by year-end—it was 3.7% in July—as financial conditions tighten and to rise further in 2024.

United States

In the last significant data release before the Federal Reserve’s next policy decision, core inflation accelerated in August compared with the two previous months, the Bureau of Labor Statistics reported. Although both core and headline inflation marginally exceeded our expectations, we don’t see cause for concern. Shelter costs continue to trend lower, goods prices have been deflationary, and—outside of volatile transportation prices—services prices have been largely within expectations.

- We still expect year-over-year headline inflation of 3.2% and core inflation of 3.6% to end 2023, based on the Personal Consumption Expenditures Index, one of two key U.S. inflation indicators. However, given recent volatility in energy prices, the upside risk to our headline forecast has increased.

- We forecast another 25–75 basis points of Fed rate hikes before the end of the current monetary tightening cycle. The Fed’s current rate target is 5.25%–5.5%, a 22-year high.

- Our view that the Fed may raise its rate target by 25–75 basis points is in line with market expectations, though we differ from the market on when the cycle will reverse. Markets foresee rate cuts early next year, while we foresee rate cuts starting only in the second half of 2024. We believe the catalyst for easing would be either a recession or inflation falling while economic activity remains strong (a “soft landing”). A recession appears significantly more likely.

- We recently increased our forecast for 2023 GDP growth to 1.8%. Recession in the next 18 months remains our baseline expectation, though we now peg the probability of recession at about 70%, down from our previous view of more than 90%.

China

A September 15 release of data on retail and housing sales, industrial production, and fixed asset investment will say a lot about whether an economy that has struggled for several months may have hit its bottom.

- “Recent data releases on trade, inflation, and credit demand weren’t as dire as many had expected,” said Grant Feng, a Vanguard senior economist. “One month of data isn’t enough to say things have turned around, and China’s economic challenges certainly aren’t over, but further promising data this week would offer more evidence of potential stabilisation.”

- After a brief foray into deflation in July, when broad consumer prices fell on a year-over-year basis, consumer prices rose 0.1% year-over-year in August and 0.3% month-over-month. Producer prices continued to fall, declining by 3.0% in August from a year earlier, less than the 4.4% year-over-year drop in July. We expect headline inflation of 0.5%–1.0% for the full year.

- We maintain our view for full-year economic growth in a range of 5.25%–5.75%, with risks tilted to the lower end of our forecast range.

Euro area

The European Central Bank (ECB) announced a 25-basis-point rate hike on September 14, taking its deposit facility rate to 4%. With that, Vanguard believes the bank has reached its peak rate in a hiking cycle that began in July 2022.

- “The manufacturing sector has been in a deep malaise for a year, and broader high-frequency data have been weak in the third quarter,” said Shaan Raithatha, a Vanguard senior economist. “Given our expectation that already-implemented monetary policy tightening will have its maximum impact in the next two quarters, we don’t expect the ECB will see a need for further rate hikes.” We expect the ECB to leave rates on hold until the middle of 2024.

- The hiking cycle was initiated to counter generationally high inflation. Headline inflation was unchanged at 5.3% in August compared with a year earlier, according to Eurostat, the European Union’s statistical agency. We expect a sharp disinflationary trajectory for the remainder of 2023, with core inflation ending the year at about 3.3%.

- As with the United Kingdom, we are skeptical about the prospect for “painless disinflation,” in which prices normalise without economic weakening and meaningful job losses. We expect the unemployment rate to rise to 7%, though risks skew to the downside.

- We attach a 90% probability to recession in the next 18 months. In our base case, we expect the economy to contract in the third and fourth quarters of 2023.

United Kingdom

Inflation and wage pressures remain strong even as high-frequency data suggest economic weakening in the third quarter.

- We continue to foresee a rate peak of 5.5%–5.75%. Persistently strong wage and inflation data could cause the Bank of England (BOE) to hike beyond our forecast peak.

- We expect both headline and core inflation to fall to close to 5% by the end of 2023, led by favourable comparisons to year-earlier prices for energy, food, and core goods. But we foresee limited progress on services inflation the rest of the year.

- The latest employment report sent mixed signals. “Although wage growth remains hot, there are signs of labour market easing,” said Raithatha. “Employment fell further, job vacancies dropped below 1 million for the first time since 2021, and the unemployment rate ticked up. We believe the BOE will almost certainly raise the bank rate in its September meeting. The next meeting, in November, will be a closer call.”

- We continue to expect full-year 2023 GDP to be largely unchanged from 2022. Our base case remains that the U.K. economy will enter recession within the next 18 months.

Emerging markets

Continued progress on inflation has enabled further interest rate cuts in Latin America. Banco Central Chile cut its key interest rate by 75 basis points on September 5, to 9.5%, following a 100-basis-point cut in late July. Banco Central do Brasil is widely expected to announce on September 19 that it will further lower its Selic rate. At its last meeting, the central bank lowered the Selic by 50 basis points to 13.25%.

- Vanguard is watching how emerging markets contend with a U.S. dollar that appreciated against leading global currencies over the last eight weeks.

- “The primary risk now for emerging markets from an appreciating dollar is that it raises the cost of dollar-denominated imports, which can drive inflation and slow the timing of interest rate cuts that are important to growth,” said Vytas Maciulis, a Vanguard economist. Emerging markets have often used higher interest rates as a tool for defending currencies.

- We’re also watching for potential effects of slowing growth in China. To date, the effects have been minimal amid global economic resilience and given greater diversification in global trade to countries including Mexico, South Korea, and Vietnam.

Canada

Whether the Bank of Canada (BOC) has reached the end of its rate-hiking cycle may be a matter of whether slowing economic growth translates into decelerating inflation and wage growth. The BOC held its overnight rate target steady at 5.0% on September 6, noting that the Canadian economy had “entered a period of weaker growth, which is needed to relieve price pressures.”

- We believe the BOC has likely reached its overnight rate target peak, though risks skew to the upside.

- We continue to foresee 2023 GDP growth of just less than 1% and the onset of recession this year as the effects of higher interest rates spread through the economy. Our proprietary measure of leading indicators remains in negative territory, suggesting slowing activity.

- Despite slowing growth, the BOC will want to see progress in reducing inflation. The average of the BOC’s two primary measures of core inflation fell from 3.9% year-on-year in June to 3.5% in July. But that’s only marginally lower than at the start of the year. A similar story is playing out for wages, where the measures the BOC most closely watches continue to show year-over-year growth between 4% and 5%.

- “The strength of forthcoming data will be important as the Bank of Canada considers its next move,” said Rhea Thomas, a Vanguard economist. “Does the bank look at growth and say, ‘Done,’ or does it look at inflation and wages and say, ‘We need to go further?’”

Vanguard’s outlook for financial markets

Our 10-year annualised nominal return and volatility forecasts are shown below. They are based on the June 30, 2023, running of the Vanguard Capital Markets Model (VCMM). Equity returns reflect a range of 2 percentage points around the 50th percentile of the distribution of probable outcomes. Fixed income returns reflect a 1-point range around the 50th percentile. More extreme returns are possible.

Australian equities: 4.2%–6.2% (21.7% median volatility)

Global ex-Australia equities (unhedged): 4.8%–6.8% (19.4%)

Australian aggregate bonds: 3.8%–4.8% (5.5%)

Global bonds ex-Australia (hedged): 4.0%–5.0% (4.7%)

Notes:

All investing is subject to risk, including the possible loss of the money you invest.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

Important

The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

This article contains certain 'forward looking' statements. Forward looking statements, opinions and estimates provided in this article are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current market conditions. Forward-looking statements including projections, indications or guidance on future earnings or financial position and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance. There can be no assurance that actual outcomes will not differ materially from these statements. To the full extent permitted by law, Vanguard Investments Australia Ltd (ABN 72 072 881 086 AFSL 227263) and its directors, officers, employees, advisers, agents and intermediaries disclaim any obligation or undertaking to release any updates or revisions to the information to reflect any change in expectations or assumptions.

© 2023 Vanguard Investments Australia Ltd. All rights reserved.

By Vanguard

September 2023

vanguard.com.au